Q3/2019 Earnings Wrap up: Total Net Profit Rises 23%, Banks and Real Estate Lead

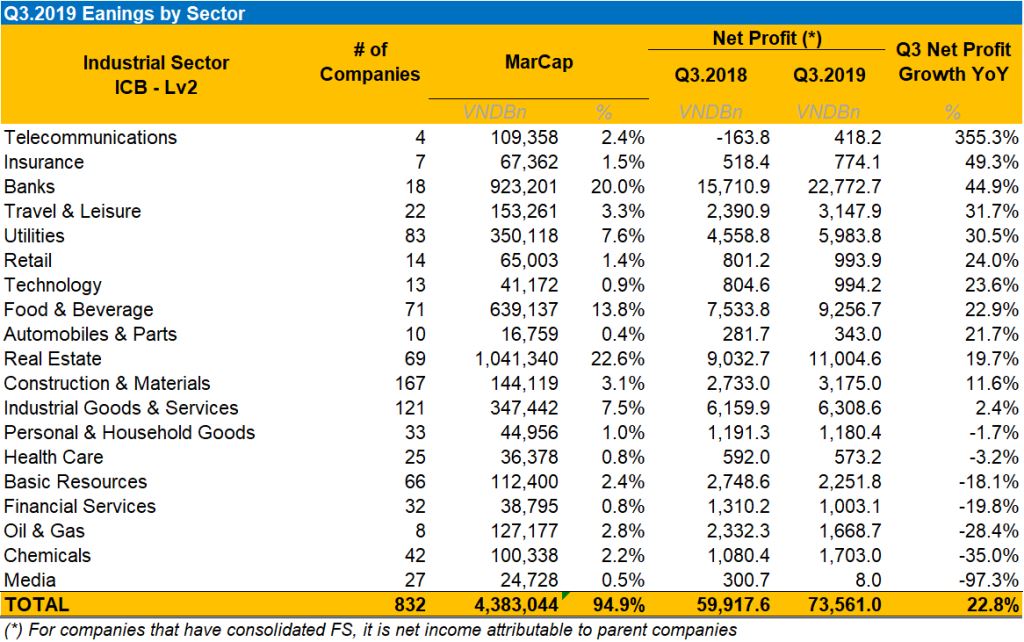

832 companies accounting for 95% of market capitalization on 3 bourses has released their Q3/2019 earnings. Of those, 706 companies or 85% reported profit; 126 companies or 15.1% have reached their profit plan for the whole year 2019

As many as 832 companies accounting for 95% of market capitalization on 3 bourses has released their Q3/2019 earnings as of November 1st, 2019, FiinPro Data shows. Of those, 706 companies or 85% reported profit; 126 companies or 15.1% have reached their profit plan for the whole year 2019. Details are as follows:

Source: FiinPro

Note: The growth rate for a sector is calculated on figures of all companies in the sector that has both data in Q3/2018 and Q3/2019.

These 832 companies recorded a total net profit of VND73.6 trillion, up 22.8% YoY. Banks earned VND22.8 trillion, accounting for 31% of the total profit, excluding the banking group, the market net profit rose 14.9% from that of Q3/2018.

In Q3/2019, the average ROE and ROA of these enterprises were 14% and 2.7% respectively; decreased from 14.9% and 4.3% in Q3/2018.

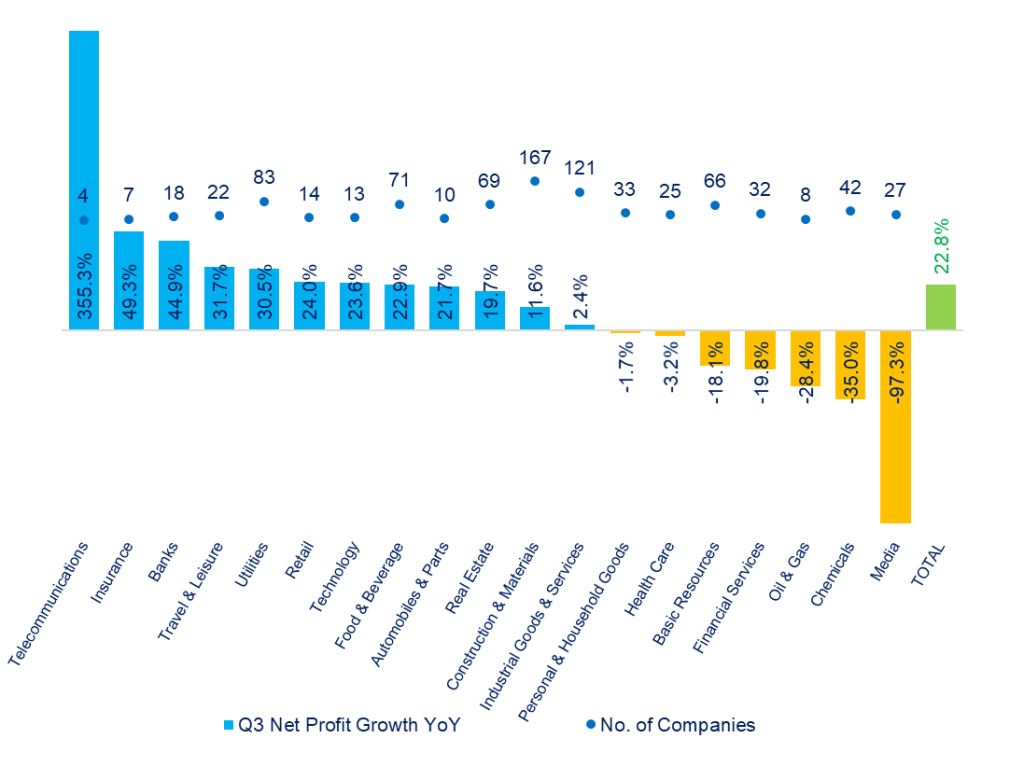

Telecommunications, Insurance and Banks were the sectors with the highest YoY net profit growth, up 355.4%, 49.3% and 45% respectively. Meanwhile Media, Chemicals and Oil & Gas were the sectors with the biggest decline in the period, down 97.3%, 35% and 28.5% yoy respectively.

Source: FiinPro

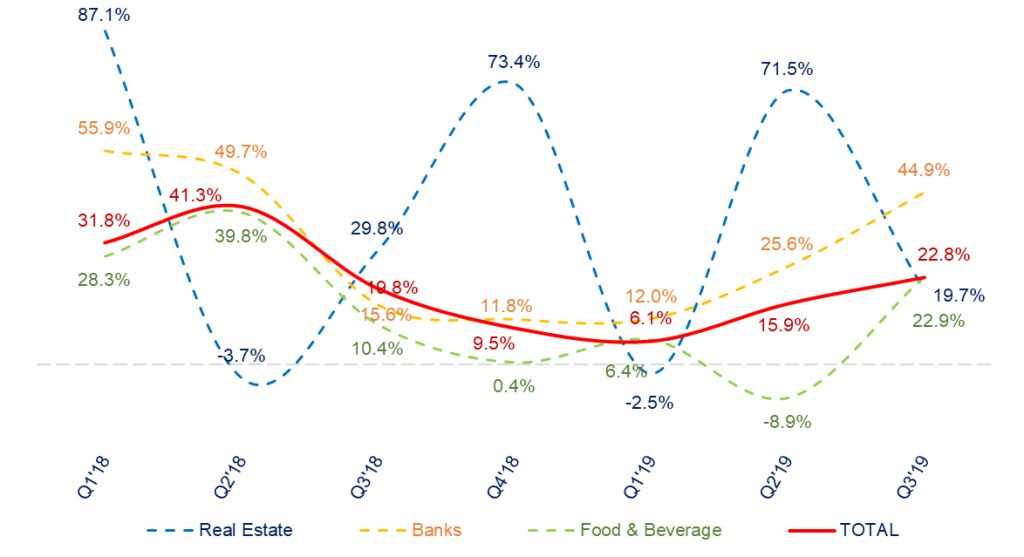

Market’s net income has recovered since Q3/2018

Source: FiinPro

By Sector:

- Banking has always played a leading role in the market, in this quarter, banks booked VND22.8 trillion net profit, up 45% yoy most remarkably from VCB. In Q3/2019, VCB posted more than VND5 trillion net profit, up 72% yoy, followed by TCB and CTG that contributed VND2.6 trillion and VND2.5 trillion respectively. Accordingly, banking’s profit growth jumped to nearly 45% in this quarter from 11.8% in Q4/2018. Total outstanding loans to customers reached VND4.9 trillion, up 13% over the same period last year.

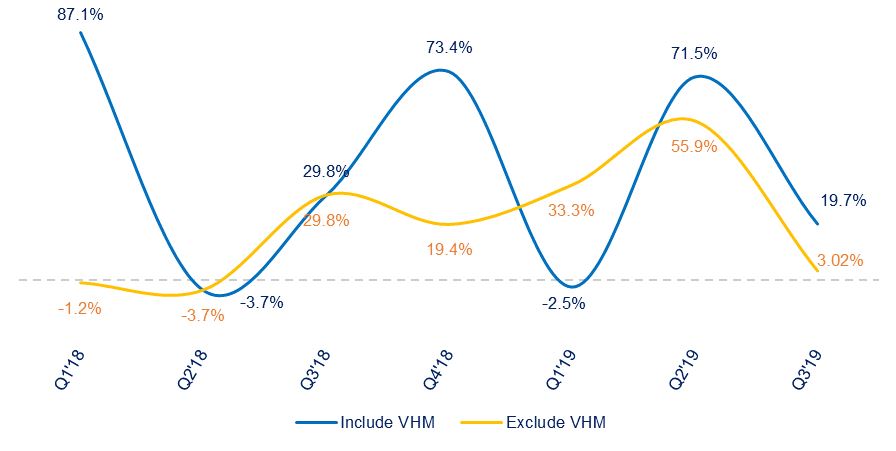

- Real Estate companies reported VND11 trillion net profit in Q3/2019, up to 19.7% from more than VND9 trillion of Q3/2018 contributing 15% to the total market net profit. Particularly VHM contributed VND5.5 trillion, accounting for nearly 50% profit of the whole industry, followed by VRE and VIC contributing VND717 billion and VND498 billion respectively. Excluding VHM, the whole real estate sector’s net profit grew by only 3% yoy.

Real estate’s net profit growth YoY

Source: FiinPro

- In terms of fastest growth, Telecommunications’ net profit soared 3.5 times yoy, mainly due to FOX's contribution with a net profit of VND340 billion, accounting for 81.3% of the whole sector. However, the sector’s net profit accounted for only 0.6% of the total market ones.

- Following Telecommunications was Insurance with a net profit growth of 49.3% yoy reaching VND774 billion, accounting for over 1% of total market profit. The high growth was mainly thanks to BVH's net profits of VND360 billion, up 3.6 times yoy.

- In contrast, Media sector saw the sharpest drop of profit growth in this quarter, the sector’s net income dropped to only VND8 billion in Q3/2019 from over VND300 billion in Q3/2018, or down by 97.3%. This decline was due to YEG's loss of VND120 billion which was the 2nd consecutive quarter of loss since YouTube ending Content Hosting Agreement (CHA) with Yeah1! from the March-end 2019.

- Chemical sector recorded a profit of VND1.7 trillion mainly thanks to the contribution of GVR’s net profit of VND980.4 billion and PHR with a net profit of VND444.8 billion. Excluding GVR, the Chemical sector grew by 35% yoy with its average ROE and ROA were 7.8% and 4.4% respectively.

« Go Back

Our Events

-

Jan 28, 2019

[FiinPro Data] 2018 Earnings Update: 82% of businesses reported profits with a 16% growth

-

Dec 07, 2018

-

Oct 22, 2018

-

Oct 09, 2018

-

Apr 28, 2020

FiinGroup - Liberation Day and International Workers' Day Closing Announcement 2020

-

Oct 22, 2018

Vietnam Real Estate - Where is the market heading to?

The domestic real estate market has had a period of strong growth in the past five years, will this bull market continue and support real estate stocks to lead the market?