A chance for CTG?

CTG has posted the modest increase of 14.2% YTD compared to its peers like VCB and BID with an upside of 67.4% and 29.7%, respectively.

The reasons behind CTG’s underperformance are that the bank's profit has been constrained due to high provisions to deal with problems in the past and difficulties in raising the charter capital.

When these issues are resolved, CTG will have a story to tell and it may offer an opportunity for investors with a strong upswing to catch up with its peers.

CTG is working hard to address past issues

CTG's profits have recently been affected due to high provisions for credit losses. At the end of 2018, CTG sold VND13.426 trillion bad debts in exchange for VAMC special bonds, meaning that the bank has to make provisions for that on a quarterly basis.

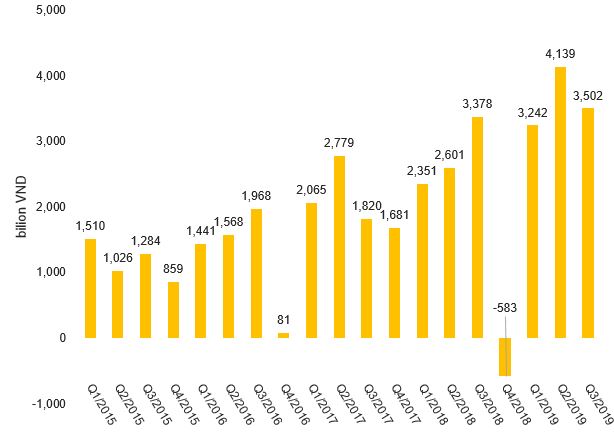

Figure 1: Provisions for credit losses of CTG

Source: FiinPro

After big provision figures in 3Q/2019, CTG is expected to clear provisions for debts sold to VAMC soon. Once it has been done, the company’s profit will rise sharply.

Difficulties in increasing charter capital

The biggest difficulty of CTG lies in raising charter capital, as the state ownership in the bank has dropped to below 65%, while the ownership ratio of foreign shareholders is at a very high level of 27.7% versus the cap of 30%. Before IFC and IFC Capitalization Fund LP completed selling 57.37 million shares on November 15, 2019, this figure was 29.24%.

According to the announcement of CTG Chairman Le Duc Tho at the 2019 general meeting of shareholders, by the end of 2018, the bank's minimum capital adequacy ratio (CAR) was 9.6% separated and 10% consolidated. However, this rate may be below 8%under Circular 41.

Difficulties in raising capital limit CTG's ability to raise credit, affecting profits. At the end of Q3/2019, CTG's outstanding loans stood at VND899.056 trillion, up 3.9% from the end of 2018, much lower than the industry average of 9.4%.

Regarding increasing capital, under current regulations, CTG has very little room to raise capital through private placement to foreign partners. In addition, although the government has agreed that state-owned banks can retain annual profits to increase their chartered capital depending on the situation of each bank, this change in mechanism can’t thoroughly address the issue. According to Le Duc Tho, even if CTG retains all its annual profits, it only meets one third of the capital raising demand.

Therefore, to increase charter capital to meet requirements, CTG has two options: waiting for the authorities to adjust the foreign ownership limit or issuing to existing shareholders.

In terms of feasibility, the first option needs to be approved and takes long time, while the second option can be difficult if the bank does not have enough resources to do so. However, this plan can still be implemented if there is a party to replace the State shareholder. According to Nguyen Chi Thanh, General Director of State Capital Investment Corporation (SCIC), SCIC can support CTG to increase capital if it is selected to participate as a State shareholder.

According to the Resolution of the regular Government meeting in October 2019, the Government assigned the Governor of the State Bank of Vietnam to report to the National Assembly on the Government's plan to increase charter capital of state-owned commercial banks. Given the importance of CTG in the banking system, it is only a matter of time before the regulators need to find a solution to raise capital for CTG. On the other hand, according to Circular 41, January 1, 2020 is the time when all banks must comply with Basel II regulations. With this deadline, the pressure to raise capital for CTG soon is very high.

Low valuation compared to the system

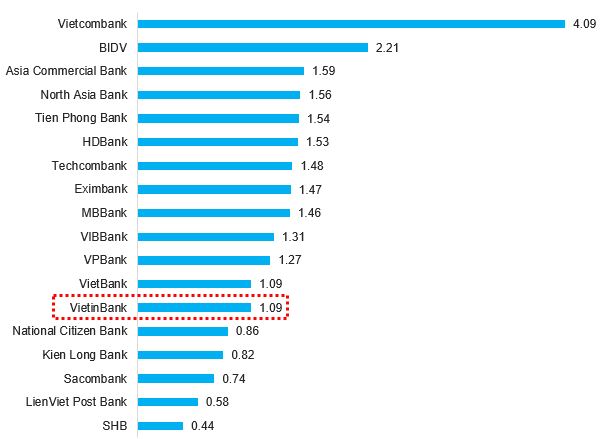

Looking at P/B, CTG is having a lower P/B than many other banks while VCB and BID have the highest P/B of the system.

Figure 2: P/B of banks listed on HOSE, HNX, UPCOM (TTM Q3/2019)

Source: FiinPro (Date of extract: November 18, 2019)

While high provision completion timeline is visible, timing for the capital increase is still unclear. However, this issue has been known to both the bank and the market. If CTG solves the problem of raising capital, the bank will drastically improve fundamentals and its profit will rebound, so CTG share may turn around with fast upswing, catching up with its peer.

Disclaimer: This article was made by FiinGroup's analysis team only to serve our FiinPro and FiinTrade subscription customers. FiinGroup is an independent data service provider; the company and its data analysts do not make recommendations, provide brokerage services or engage in securities trading.

« Go Back

Our Events

-

Jan 28, 2019

[FiinPro Data] 2018 Earnings Update: 82% of businesses reported profits with a 16% growth

-

Dec 07, 2018

-

Oct 22, 2018

-

Oct 09, 2018

-

Apr 28, 2020

FiinGroup - Liberation Day and International Workers' Day Closing Announcement 2020

-

Oct 22, 2018

Vietnam Real Estate - Where is the market heading to?

The domestic real estate market has had a period of strong growth in the past five years, will this bull market continue and support real estate stocks to lead the market?