FiinPro Earnings Tracking: Earnings quality falls despite strong profit growth

FiinPro Earnings Tracking: Earnings quality falls despite strong profit growth

FiinPro Earnings Tracking is a periodic newsletter to update and analyze the profit quality of listed companies on Vietnam stock market for purpose of better serving our subscribers to FiinPro and FiinTrade platform. FiinGroup is an independent data service provider and the Company and its data analysts do not make any recommendations or provide brokerage services and do not engage in securities trading as well.

This review is based on data analysis of Q3/2019 financial statements of 1,047 listed companies which represented 99.99% of the total marketcap on 3 bourses as of Nov 16, 2019. The data is categorized into two groups: including & excluding VinGroup (VIC) and its consolidated companies (VHM, VRE, SDI & VEF) which are those having at least 51% stake owned by VinGroup.

Highlights:

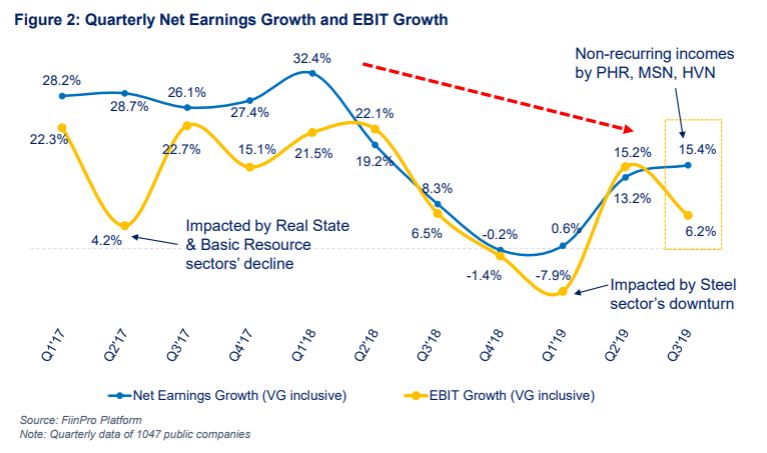

- Including VinGroup’s companies: Despite decline in net sales growth, net earnings still grew at 15.4% YoY in Q3/2019.

- Excluding VinGroup’s companies: EBIT & EBITDA growth slowed down for the 6th consecutive quarter in Q3/2019, indicating that the earnings quality of non-VinGroup companies has been deteriorating.

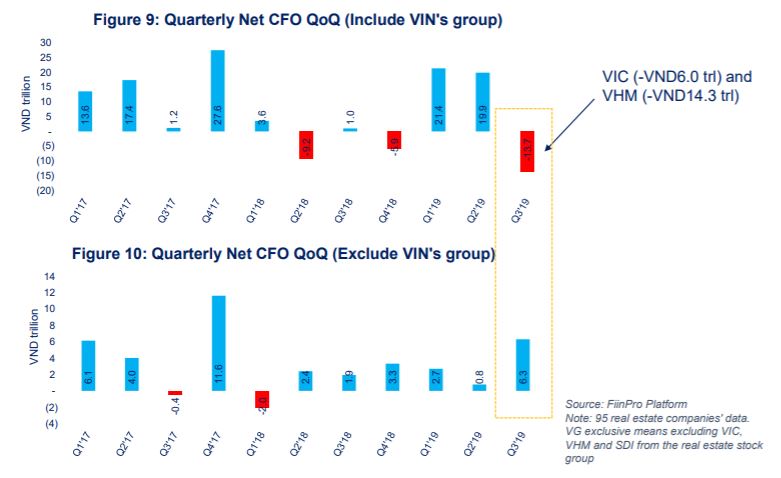

- Including VinGroup’s companies: Q3/2019 Net Operating Cashflow (CFO) turned negative, arising from large deficit in Real Estate sector where VIC and VHM recorded a combined net CFO negative at VND20 trillion due to the rising inventories and account receivables.

- Including VinGroup’s companies: Net Earnings of Real Estate sector grew 15.3% YoY, but non-VinGroup companies saw net earnings down 0.5%.

Q3/2019 earnings performance of listed companies:

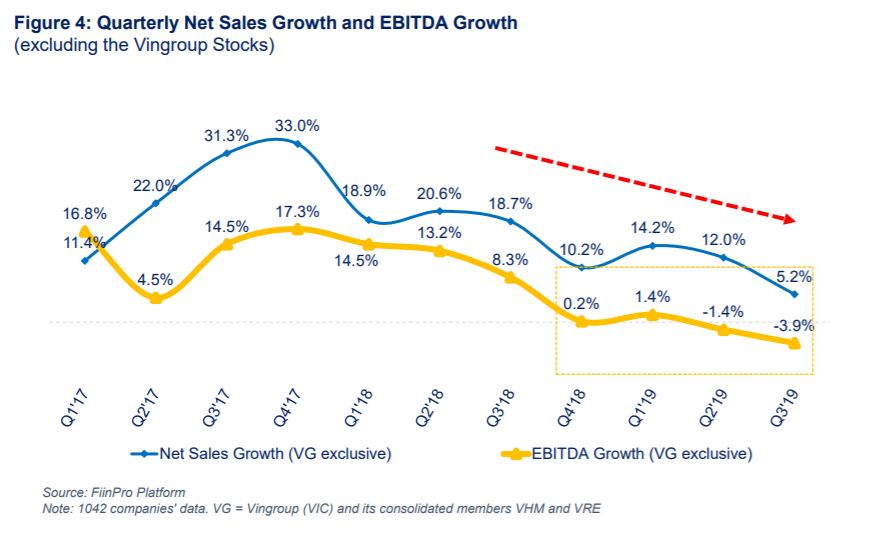

Including VinGroup: Net sales growth slowed to a single-digit number for the first time since Q1/2017 while EBITDA growth continued its downtrend. Revenue growth kept declining from 33.5% in Q3/2017 as low as 6.9% in Q3/2019.

Q3/2019 net profit increased 15.4% YoY, but EBIT grew only 6.2 %, indicating that net profit growth was fueled by non-recurring incomes instead of core businesses. PHR, MSN and HVN are among those having big irregular incomes. The 164% YoY net profit growth of MSN came from Jacobs E&C’s compensation in the lawsuit where the latter lost and awarded damages of approximately $130 million to NPM - a tier 2 subsidiary of MSN. HVN’s net profit growth of 147.2% is contributed by another income of over VND200 billion and decrease in losses from exchange rate differences while land clearance compensation helped boost PHR’s net profit by 167%.

If VinGroup and its consolidated companies are excluded, net revenue and EBITDA growth saw no remarkable improvement in recent 4Qs and declined steadily since Q4/2017.

Q3/2019 EBIT growth was negative at 6.8% - the lowest level since Q2/2018 and the sixth consecutive quarter of EBIT growth going down despite a positive net profit growth in the first 3 quarters of this year.

Real Estate sector: Performance review of listed real estate companies is completely different when VinGroup & its consolidated companies are included or excluded. The most significant difference is seen in the net cash flow from operating activities (CFO). In Q3/2019, net CFO of listed real estate companies was negative at VND13.7 trillion but it turned positive at VND6.3 trillion if excluding when VinGroup & its consolidated companies

The data was collected from FiinPro Platform, for further information, please visit FiinPro Platform or click here to download the full content.

We hope FiinPro Platform's data updates supports your work effectively. Should you need any help or support, please contact our Customer Care Department:

Hanoi:

Thi Lan Do (Ms.)

E: lan.do@fiingroup.vn

Tel: 024 3562 6962 ext: 103

« Go Back