XMC: Profit soared in Q3/2019

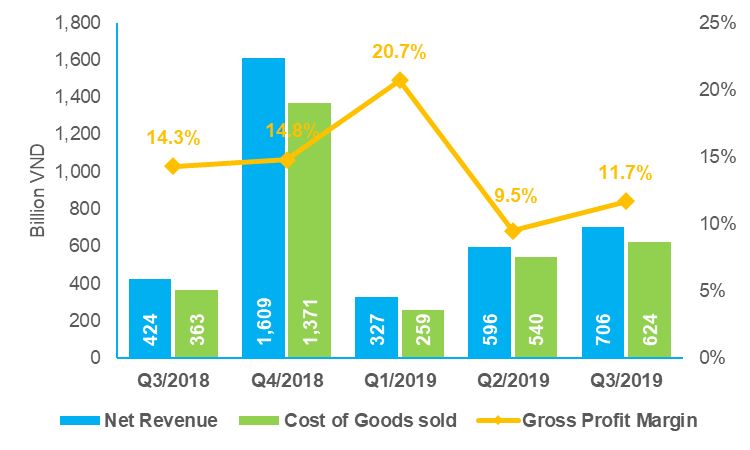

Xuan Mai Investment and Construction Corporation (XMC) has just released the consolidated financial statement Q3/2019. The net revenue increased by 66.64% to VND706 billion while the pretax profit soared by 95.8% to reach VND19 billion y-o-y.

Source: FiinPro

In the quarter, cost of goods sold over the net revenue inched up by 2.6%, which caused the gross profit margin to decrease from 14.25% in Q3/2018 to 11.69% in Q3/2019. In addition, selling expenses, and general and admin expenses declined by 0.94% and 3.35% respectively.

Financial expense (mainly interest paid for loans) rose by 60% to VND36 billion while financial income was just 0.45 billion.

In Q3/2019, XMC generated a pretax profit of VND19.09 billion to increase by 95.8 % y-o-y.

For the three early quarters of this year, the net revenue increased by 31% to VND1,628 billion while the pretax profit inched down to VND33.46 billion y-o-y.

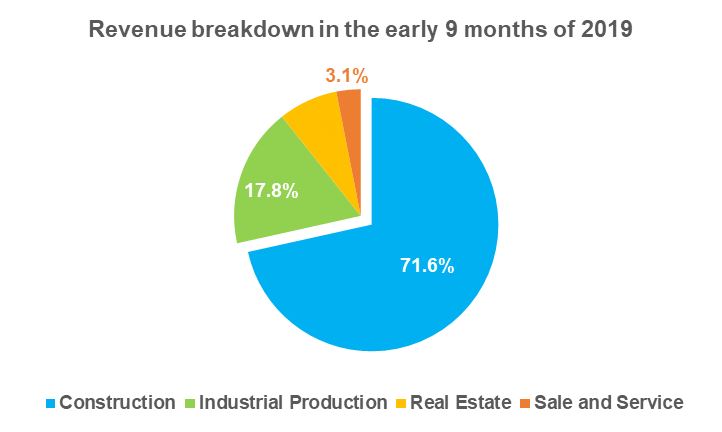

Source: FiinPro

For the 9 months, construction played a key role to contribute 71.6% of the total revenue. And the industrial production stood behind with 18%.

In recent years, XMC’s net profit margin was declining from 2.98% in 2015 to 2.74% (TTM) in Q3/2019. ROE weakened from 13.9% in 2015 to 12.8% in this quarter while ROA was from 2.1% to 1.9%.

According to the cash flow statements, interest is a burden of XMC when cash from operation (CFO) is not adequate enough to pay interests. It forces the Company to obtain new loans to pay for the interests. XMC owns a high financial leverage. Debt over equity is 3.7 while liabilities over equity is 6.3.

On October 22, 2019, XMC was closed at VND9,800 per share to decrease by 20% compared to one at the beginning of the year. XMC is being traded at P/E = 6x and P/B= 0.94.

« Go Back

Our Events

-

Jan 28, 2019

[FiinPro Data] 2018 Earnings Update: 82% of businesses reported profits with a 16% growth

-

Dec 07, 2018

-

Oct 22, 2018

-

Oct 09, 2018

-

Apr 28, 2020

FiinGroup - Liberation Day and International Workers' Day Closing Announcement 2020

-

Oct 22, 2018

Vietnam Real Estate - Where is the market heading to?

The domestic real estate market has had a period of strong growth in the past five years, will this bull market continue and support real estate stocks to lead the market?