FiinPro Data #2: Corporate Earnings Growth is Slowing Down

2019 is the second year when non-financial companies' revenue and profit growth is slowing down:

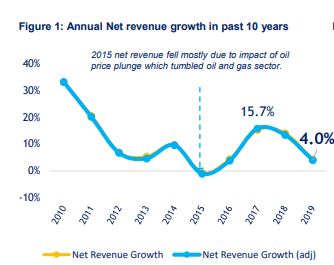

- Net revenue grew modestly at 4.2%, ended the rapid chain-growth in recent years.

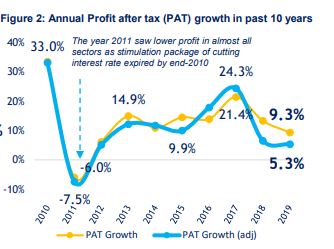

- Profit after tax in 2019 grew only by 5.3% but it was still in the decrease stage.

- After phase of crisis (2008 -2012), 2019 is the first time EBIT and EBITDA growth declined to -1.5% and -1.1%

Sectors that maintained high income and growth rate in 2019 are Pharmaceuticals, Personal & Household Goods, Construction & Materials and Telecommunications. We rated based on two criterial: Incomes and Profits.

18 banks (accounts for a combined 67.4% of total outstanding loans) recorded an after-tax profit growth of 29.3%, had a credit growth of 15.5%, higher than the whole sector (13.5%).

- Net profit margin (NIM) had improved at 30 basis points to 3.4% from 3.1% in 2018 due to retail lending growth from some banks through subsidiaries such as VPBank, HDBank, MBBank and more recently SHB.

- Fee income of these banks grew strongly at 30.7%

EPS growth of VN30 is forecast at 15.3%, much higher than actual figure of 4.9% in 2019.

The series of report “FiinPro Data Digest” in 2020 is premium product serving FiinGroup customers, subscribers of FiinPro Platform and FiinTrade Platform. We expect that the series of report “FiinPro Data Digest” would provide multi-dimensional and in-depth perspective in terms of different aspects in the market from data analytic.

This report has been prepared by our Data Analytics Team under the FiinGroup's Financial Information division with the expectation of providing you with valuable information.

You can download Lite version for this report HERE

You can register to receive Full version for this report HERE

Wishing you a successful year ahead and happy investing!

« Quay lại

Our Events

-

Jan 28, 2019

[FiinPro Data] 2018 Earnings Update: 82% of businesses reported profits with a 16% growth

-

Dec 07, 2018

-

Oct 22, 2018

-

Oct 09, 2018

-

28/04/2020

-

09/10/2018

Đầu tư ngành ngân hàng liệu còn hấp dẫn?

Cổ phiếu ngành Ngân hàng là một trong những nhóm cổ phiếu dẫn dắt thị trường trong suốt những năm qua. Số liệu FiinPro cho thấy cổ phiếu ngành này đã đạt mức tăng trưởng 3 con số trong năm năm qua, tăng 154.1% so với mức tăng 2 con số của VNIndex là 96.5%. Liệu sức hấp dẫn của cổ phiếu Ngân hàng có còn trong những tháng cuối năm 2018 và năm 2019?