StoxPlus Provides New Data on FiinPro Platform Version 1.0.5

Dear valued customers,

We would like to extend our sincere thanks to valued customers who have been trusting and supporting us through using StoxPlus’ FiinPro. We believe that our FiinPro has been providing you with useful data to boost your operation efficiency.

StoxPlus, with our motto of “Innovative always” in financial information service industry in Vietnam, has been making efforts and committed to providing customers additional unique features, functions, datasets and tools on FiinPro Platform on regular basis.

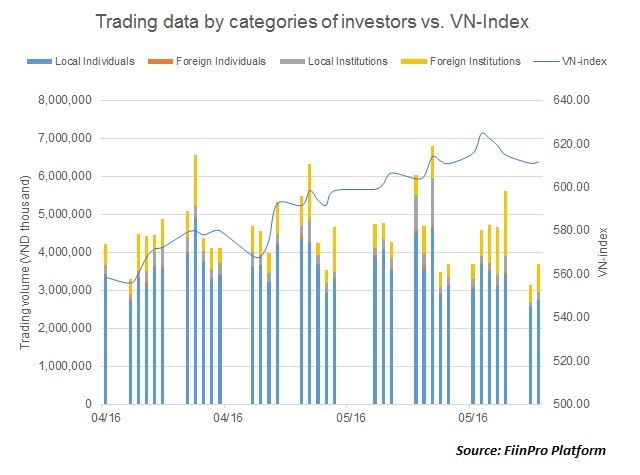

We are proud to announce today, May 25, 2016 that FiinPro is the only one on the market that you can find daily trading data by categories of investors (institutional and retail investors). This illustrates StoxPlus’ continuous efforts to provide our customers in-depth market level 2 data in line with international standards and practice.

Trading data by categories is updated daily at 5:00 pm Vietnam time. The data consists of market data, stock data classified by four categories: local retail investors, foreign retail investors, local institutional investors, foreign institutional investors. The data is now available for stocks listed on the Hochiminh Stock Exchange (HOSE) and StoxPlus is working with the Hanoi Stock Exchange (HNX) to achieve the data for stocks listed on the bourse.

The data will enable users to know exactly which categories of investors dominate on the stock market by transaction value. Retail investors currently account for over 70% of the trading value, however, it is foreign institutional investors who are the key opinion leaders driving the local mass which is psychological.

« Go Back